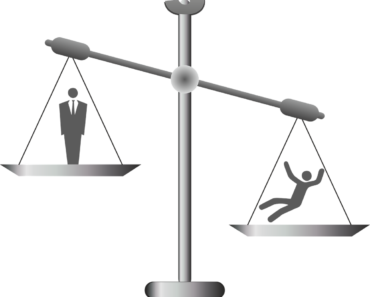

The 21st Century has been interesting for Florida Homeowners. We have seen the rise and fall of Real Estate over and over again. Unfortunately, we may be entering the downside as many have started to default on their mortgages. While there are uncertainties, there are ways to prevent the Bank from taking your property. Therefore, if you need to delay the Process and avoid losing your home, contact our office at 954.237.7740.

Respond To The Foreclosure Complaint

A Homeowner has 20 days to respond once served with a Foreclosure. Failing to respond is the worst decision they can make. If you fail to respond, a default will be entered. This results in a Final Judgment. Accordingly, this can take less than 4 months. In addition, if they do not hire an Foreclosure Defense Attorney, the Bank will quickly move the case to a Final Judgment.

On the other hand, if you hire a Foreclosure Defense Attorney, the Foreclosure timeline changes. First, the Attorney will review the Complaint and determine if there are any defenses. Secondly, they will delay the speed of the case to allow a Homeowner the opportunity to sell their property through a short sale or attempt a Loan Modification.

Selling Your Property Through A Short Sale

Many Homeowners owe more than the value of their property. As a result, some decide to sell their property through a Short Sale. The benefit is if the Bank approves the offer and there is a Foreclosure Auction scheduled, they will request a cancellation. In addition, if there is a Non-Jury Trial and the Short Sale has been approved, they may request a continuance with the Court. Therefore, selling your property through a Short Sale is a way to delay the Foreclosure Process in Florida.

Apply For A Loan Modification

The Process allows the Bank to determine the amount a Homeowner will pay based on their income and debt. If they are approved, they will enter a trial plan. This requires them to make 3 payments. If they make all payments, they are given a modification.

How Does This Delay A Foreclosure Case?

If the Bank approves a Loan Modification, they often request the Court to put the case on hold. Accordingly, if there is an upcoming Sale, they will request that the Court cancel it. In addition, if there is a Non-Jury Trial, they will request a continuance as they do for a Short Sale Approval.

Foreclosure Mediation

Mediation was required by the Courts during the Recession in 2008-2011. Thereafter, it was only available if one of the parties requested it. While not mandatory, it is a way for a Homeowner to resolve the case. Many times, if the Bank has received the Homeowner’s documents prior to mediation, they may agree to place the case on hold. In addition, if there is a scheduled Foreclosure Sale, they may request that the Court cancel it.

The Foreclosure Process can be stressful without representation. Banks will find any advantage they can to move the case through the Courts. Therefore, it is important to meet with Attorneys that will explain all options available to you. Contact 954 Foreclosure Attorneys, PLLC at 954.237.7740.