The last year and a half has been difficult for many Homeowners in Broward County. As a result of the severe negative economic effects of the Coronavirus, many have been unable to pay their mortgage. However, it does not mean they will lose their property. If you have questions about how the Coronavirus has Effected Broward County Foreclosures, contact 954 Foreclosure Attorneys at 954.237.7740.

How Has The Coronavirus Effected Broward County Foreclosures?

In March of 2020, the Federal Government set a Moratorium on Foreclosures providing relief to Homeowners. As a result, many have put their mortgage on Forbearance. This allowed them to delay payments on their home until the Moratorium is lifted. While some recovered, others have not been so lucky. This has created uncertainty for many but still have been helped by the Court’s inability to proceed. Unfortunately, Florida does not have extensive programs to aid Homeowners in Foreclosure. The larger banks including Wells Fargo, Chase, and Bank of America have halted most of their cases to allow Homeowners a chance to apply for a Modification or Repayment plan.

On July 31, 2021, the Federal Government will end the Moratorium. Broward Homeowners in Foreclosure that have not been able to modify their loan or obtain a repayment plan face an uphill battle. They will also be faced with important decisions regarding their property: Should I continue to try and obtain a Loan Modification or sell my property. Regardless of their choice, it is important they also pay attention to their case.

The Benefit Of Speaking To A Broward County Foreclosure Defense Lawyer During This Time

If you have been unable to qualify for a Modification or program offered by the Banks, you should speak to a Broward County Defense Lawyer. They can provide an array of benefits including:

- Representation in Court;

- Corresponding with the Bank to explore other options; and

- Help protect your investment.

Representation In Court

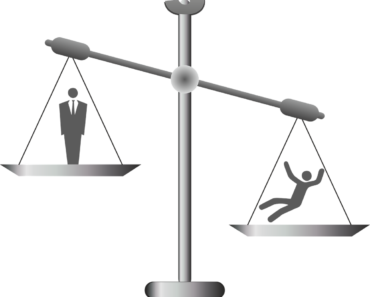

Having Aggressive Representation is without question the biggest benefit that you will receive. Once the Moratorium is lifted, the Bank’s Attorneys will try to move your case to Judgment. They know that their efforts will be delayed if a Homeowner is represented by an experienced Broward County Foreclosure Defense Lawyer.

Corresponding With The Bank

The next benefit a Homeowner in Foreclosure will receive is their Attorney will communicate on their behalf. It is no secret that it can be difficult making contact with the Bank’s Representatives. Not only are you kept on hold for an extended period of time, you never speak to the same person. An aggressive Broward County Foreclosure Defense lawyer will be able to not only defend against the Foreclosure, they can be speak directly to the Bank. This will save you time during your day as well as the constant aggravation and stress.

Help Protect Your Investment

Finally, a Broward County Foreclosure Defense Lawyer will guide you in making the right decision. For example, unless you have not watched the news in the last year and a half, you know that home prices have skyrocketed. While your home may be in Foreclosure, you may have equity as the amount you owe may be less than its’ value. If that is the case, a Broward County Foreclosure Defense Lawyer will encourage you to sell your property. However, if you do not have equity and owe more than the property is worth, they will likely try to help you keep it if that is your goal. On the other hand, if they do not believe that it is in your best interest, they may assist you with a short sale.

The Coronavirus has created stress for Homeowners in Foreclosure. However, having competent representation by a Broward County Foreclosure Defense Lawyer may be your answer to these difficult times. If you have questions about how the Coronavirus has effected Broward County Foreclosures, contact 954 Foreclosure Attorneys at 954.237.7740.