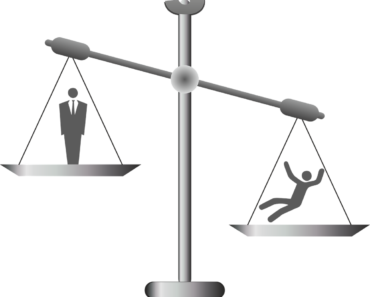

Coral Springs FL was hit hard during the recession and the years that followed. Many Homeowners lost their home to Foreclosure and could not purchase a property for several years after. This was due to not being able to obtain a mortgage from the Bank. However, they were encouraged to apply for a Loan Modification. Unable to qualify, many lost their properties to the Banks.

The people that lost their homes now have a difficult time obtaining a mortgage. In addition, Lenders have tightened their requirements. For example, they will not extend credit to Homeowners with a negative credit history or that lost their home to Foreclosure. However, there is a positive side that many do not use to their advantage: Selling their property through a Short Sale.

The Short Sale process can be lengthy but if Homeowners act quickly, they can sell at a reduced amount. Accordingly, if the Bank accepts the offer, they usually waive the shortage they are owed. What does this mean for the Homeowner? Selling their property through a short sale allows them to recover quicker. In addition, they can avoid the negative effects of a Foreclosure. Secondly, it is less drastic for your credit. In other words, a Credit Report will not show a Foreclosure but will say “settled” or “short sale.” Finally, if they forego the Short Sale process and spend years and money trying to obtain a loan modification, they lose out on other ventures including saving for retirement.

Selling Your home in Coral Springs FL through a Short Sale may benefit you. Therefore, if you are unsure about the Short sale Process, contact 954 Foreclosure Attorneys, PLLC at 954.237.7740.