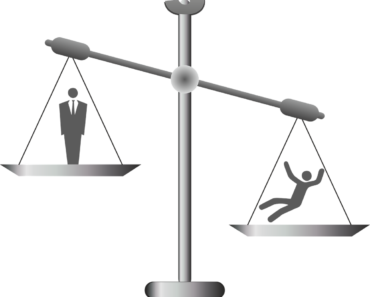

Florida Foreclosure Basics

If you’re having trouble paying your mortgage, there are a few options available to you. Let’s break down the Florida Foreclosure Basics in everyday language:

- Loan Modification: This is when the terms of your mortgage loan get changed to make it more affordable for you. This could involve lowering your interest rate, extending your loan term, or reducing the amount you owe. The goal is to help you avoid foreclosure and stay in your home.

- Short Sale: A short sale is when you sell your home for less than you owe on the mortgage. The lender agrees to accept the proceeds of the sale as payment in full for the loan, even if it doesn’t cover the full amount owed. You avoid foreclosure, but you lose your home.

- Deed in Lieu of Foreclosure: With a deed in lieu of foreclosure, you voluntarily give ownership of your home to the lender in exchange for them agreeing not to foreclose. This can be a good option if you can’t afford your mortgage payments and don’t want to go through foreclosure, but you also don’t want to sell your home.

- Foreclosure Defense: This is when you work with an attorney, such as 954 Foreclosure Attorneys, to fight against foreclosure. They can help you challenge the lender’s right to foreclose, negotiate with the lender for a loan modification or other options, and represent you in court.

Ultimately, which option is best for you will depend on your individual situation and goals. It’s always a good idea to consult with 954 Foreclosure Attorneys for help so you can make the best decision for you and your family. Call your Florida Foreclosure Defense Attorneys today @ 954.237.7740. We represent homeowners throughout the State of Florida.