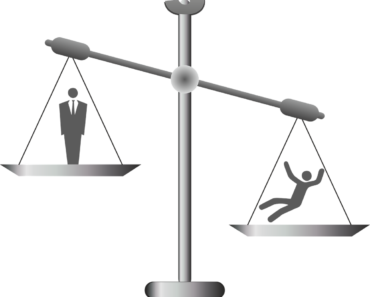

HOA Lien Foreclosure vs. Bank Foreclosure? Both have the aim of foreclosing on a property and selling it at a sale. The main difference is the duration of time it takes to foreclose. In addition, a Homeowner has less defenses in an HOA Lien Foreclosure. Most of the time, they are foreclosing on a Lien for failing to pay dues or assessment. The average time can be around six (6) months. There are also less hurdles that they have to overcome to obtain a Final Judgment of Lien Foreclosure.

HOA Lien Foreclosure vs. Bank Foreclosure? Both have the aim of foreclosing on a property and selling it at a sale. The main difference is the duration of time it takes to foreclose. In addition, a Homeowner has less defenses in an HOA Lien Foreclosure. Most of the time, they are foreclosing on a Lien for failing to pay dues or assessment. The average time can be around six (6) months. There are also less hurdles that they have to overcome to obtain a Final Judgment of Lien Foreclosure.

How is a Bank Foreclosure Different?

There are more parties as well as extensive documentation that has to be provided. The average time it takes is 9 months to over a year. However, they typically have more defenses and options such as a loan modification, short sale, or a deed in lieu. As a result, the Foreclosure will be delayed.

If you have been served with an HOA Lien or Bank Foreclosure and need to know your rights, contact 954 Foreclosure Attorneys, PLLC at (954) 237-7740. Let the experienced Attorneys with a combined 25 years of experience fight for you. We have offices in both Broward and Palm Beach Counties to better serve our clients.